A lightning strike is a powerful electric discharge in the atmosphere. It happens during storms when clouds build up electric charges. Lightning can be dangerous, so it’s important to stay safe during thunderstorms.

Most standard car insurance policies cover damage from lightning strikes. Lightning can fry a car’s electrical system or start a fire. Insurance typically covers the cost to repair or replace affected parts. You need comprehensive coverage for lightning protection.

Your deductible will apply for lightning damage claims. File a claim promptly if your car is struck. Provide evidence like photos or reports on the storm.

When does car insurance cover lightning strikes?

Car insurance covers lightning strike damage if you have comprehensive coverage. Comprehensive covers fire, vandalism, theft, and weather incidents. It’s optional, but lenders require it if you finance or lease. Review your policy for detailed lightning coverage.

Lightning can melt wires, circuits, and batteries. The electrical surge may also start interior fires. Insurers cover repairs or replacement value.

Comprehensive claims are subject to your deductible amount. Take photos documenting the lightning damage right away. Then promptly file a claim with your insurance company. They’ll review the evidence and compensate you if the claim is approved.

How do you file a claim for lightning strikes?

If your car gets struck by lightning, you’ll need to file an insurance claim. Here are the steps to go through the claims process:

- Contact your insurance company: Notify your insurer about the lightning incident right away. Most have 24/7 hotlines to start claims.

- Share any information about the event: Provide details like the date, time, location, and description of the lightning strike’s impact on your vehicle.

- Ask about your coverage: Confirm you have comprehensive coverage and understand your deductible amount before proceeding.

- Decide to make a claim: Weigh if the repair costs exceed your deductible to determine if filing is worthwhile.

- Stay on top of the claim: Respond promptly to any documentation or information requests from your insurer.

- Get your car repaired: Once approved, your insurer will issue payment for covered repairs by a shop they recommend or you choose.

When are lightning strikes not covered by car insurance?

Your car insurance policy may not cover lightning damage in some situations. Standard policies exclude lightning coverage without comprehensive coverage. Liability insurance alone does not protect against weather events. You need that optional comprehensive coverage.

Negligence can also void lightning coverage. Leaving your car’s windows open during a storm is considered negligent.

Not following advised safety precautions is another exclusion. Parking under a risky tree during a thunderstorm could prevent a claim.

Damage exceeding your policy’s limits may not be fully covered. High-end vehicles often require higher comprehensive limits for full protection. Review your policy’s lightning coverage carefully.

Related Article: Does Car Insurance Cover Battery Replacement: 2024 Guide

What happens if lightning strikes a car?

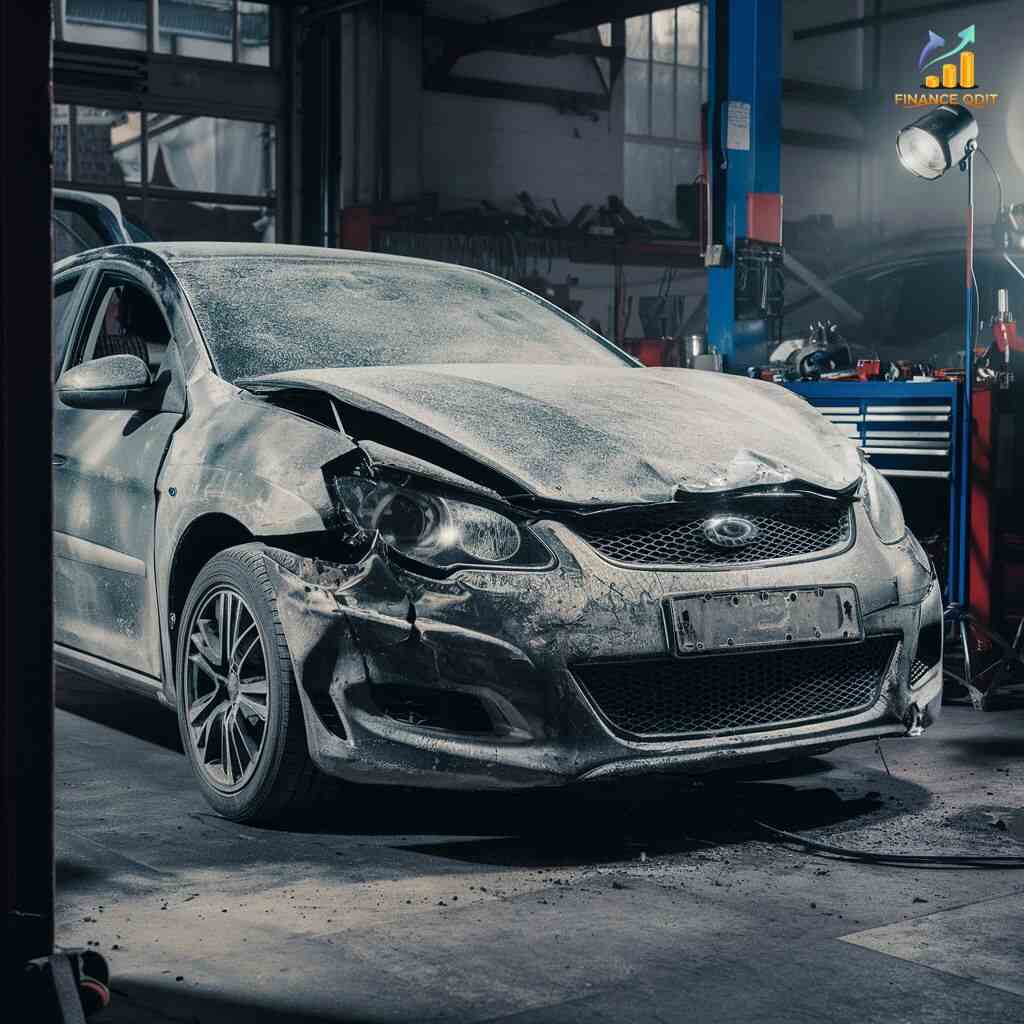

If lightning strikes your car directly, it can cause extensive damage. The electrical surge will fry the vehicle’s entire electrical system. This includes the engine computer, wiring, electronics, and battery.

Lightning can melt plastic components like lights and mirrors. The extreme heat may also start interior fires.

External damage like pits and burn marks is common. If anyone is inside when struck, serious injury is possible.

Cars do provide decent protection from lightning due to the metal body. As long as windows stay closed and occupants avoid touching surfaces, the current will travel through the frame. Still, a direct strike usually requires repairs costing thousands.

What to do when driving through lightning

Driving through a thunderstorm with lightning can be scary and dangerous. If you find yourself in this situation, follow these tips:

- Pull over and park in a safe area away from trees or poles that could fall

- Stay inside your vehicle with the windows rolled up

- Avoid touching any metal surfaces or electrical devices

- Wait at least 30 minutes after the last thunder before driving again

While inside a car during a lightning storm, you are relatively well-protected. The metal frame should allow the electrical current to travel around you if struck. However, it’s still best to delay your trip until after the storm has fully passed to eliminate any risk.

Misconceptions About Cars and Lightning Strikes

There are some common myths about how vehicles interact with lightning. Many believe rubber tires insulate the car from electrical current. This is false – the metal frame provides the protection. Tires have little impact on lightning safety.

Another misconception is convertible cars are more dangerous. While the lack of metal roof offers less shielding, convertibles still provide adequate protection. Simply keep the fabric top up during storms.

Some think tornadoes attract more lightning, but they don’t cause extra strikes. The thunderstorms that spawn tornadoes do produce frequent lightning activity. Be cautious driving in any severe weather.

Assessing Lightning Damage to Your Vehicle

When assessing lightning damage to your vehicle, thorough inspection is key. Look for visible signs such as dents, burns, or electrical malfunctions both inside and outside your car. Document the damage and promptly contact your insurance provider to start the claims process.

Taking proactive steps to assess and address lightning damage ensures your safety and protects your investment. By documenting the damage and working with your insurance company, you can expedite repairs and get back on the road with peace of mind.

Related Article: Can I Sue My Car Insurance Company?

Filing an Insurance Claim for Lightning

If your car is struck by lightning, you’ll need to file a claim with your insurance company. Acting quickly is important to get the claims process started.

- Documenting the Event: Take photos and videos of any visible lightning damage to your vehicle’s exterior and interior. Save any reports or news about the thunderstorm as well. This evidence proves the lightning strike occurred.

- Starting the Claims Process: Contact your insurer right away to notify them of the incident. They’ll provide instructions on completing claim forms and scheduling an inspection. Promptly submit all required documentation for a smoother experience.

Maximizing Your Lightning Strike Car Insurance Payout

To maximize your lightning strike car insurance payout, thorough documentation is crucial. Clear photos and detailed information support your claim.

Understanding your insurance policy is key. Review coverage details and seek clarification if needed for a smoother process.

Frequently Asked Questions

Does liability insurance cover lightning strike damage to my car?

No, you need comprehensive coverage which protects against weather events and “acts of nature”.

Do I have to pay a deductible if lightning strikes my insured vehicle?

Yes, the comprehensive coverage deductible applies to any approved lightning damage claim.

What if the repair costs exceed my policy’s coverage limits?

Any damage amounts beyond your comprehensive coverage limits would have to be paid out-of-pocket.

Is lightning damage to my car covered if I was parked under a tree during a storm?

Likely not, as that could be considered negligence which may void the coverage.

Should I file a police report documenting the lightning strike incident?

It’s a good idea to obtain an official report as additional evidence for your insurance claim.

How quickly do I need to report the lightning damage to my insurance company?

You should notify your insurer promptly, ideally within 24-48 hours after the lightning strike occurs.

Final Thoughts

Lightning strikes can cause extensive damage to vehicles. From fried electrical components to melted plastic parts and interior fires. That’s why having comprehensive coverage is so important. It protects you from these random “acts of nature”.

Many drivers mistakenly think basic liability insurance covers lightning. But comprehensive is required to file a claim. Understand your policy details ahead of time.

If your car does get struck, document evidence immediately. Then file an insurance claim right away. Following the proper process gives you the best chance of getting covered.

I write professional blogs specializing in car insurance. My content delves into various aspects of insurance policies, providing valuable insights and tips for choosing the best coverage. My goal is to make complex insurance topics accessible and engaging for all readers.